A year of friction — a recovering and fairly robust economy running up against inflation and interest rate worries — made 2023 a conundrum of sorts. Was something beginning or ending? That was the question in the construction sector, where projects that were in the pipeline ramped up, but growing concerns about the cost of money, labor availability, and recession loomed. A year of transition, possibly. To what, though, is the question.

Engineering and design firms, whose work often foretells upturns or downturns in construction, might provide some of the answers. And one vital component of that industry — electrical design — is offering some mixed, though largely upbeat, signals.

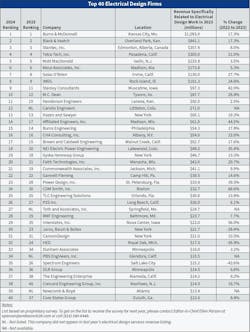

Fresh insights come from companies that make up EC&M’s 2024 Top 40, an annual ranking of design engineering firms based on revenues derived from providing electrical design services in North America. In another broad survey of business conditions and sentiment, this year’s group hit a solid new, non-inflation adjusted high in collective prior-year (2023) revenues — $4.447 billion. That’s 13% higher than the $3.918 billion last year’s Top 40 secured in 2022, which was a 22% gain over the revenue reported for 2021. Still, this year’s group weighed in with comparatively muted assessments of the year as well as their realized versus expected performance (see 2024 Rankings Table).

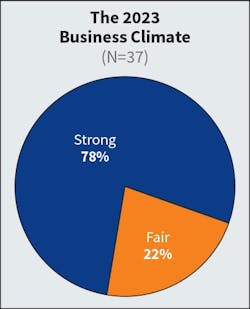

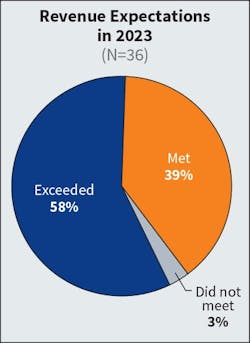

While more than three-quarters of firms rated the 2023 business climate as “strong” (Fig. 1), that was a clear falloff from last year, when 91% of firms said 2022 was strong. Defectors from the “strong” camp went to the “fair” group, which comprised 22%. None rated it “weak.” Also telling, the share saying they met or exceeded revenue expectations for the prior year declined from 66% to 58% (Fig. 2). Coming off a sparkling 2022 that saw Top 40 combined revenues vault to $3.918 billion, it may be no surprise that more firms had cooler takes on the previous past.

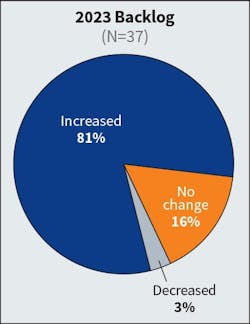

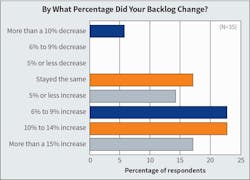

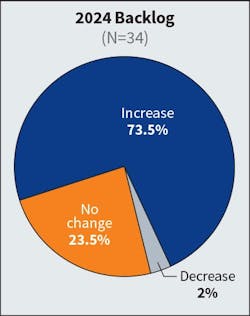

Sentiment overall, though, is hardly gloomy. Most firms (81%) said their backlog increased in 2023 (Fig. 3), evidence that their pace of banking projects that have some chance of weathering any short-term downturn isn’t slowing. Two-thirds of firms said it increased upward of 6% (Fig. 4).

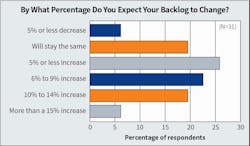

Looking ahead to the expected final tally for 2024, more than 70% say they expect their backlog to grow (Fig. 5), and 26% see it unchanged. That is a fair dropoff from the 82% of last year’s Top 40 who predicted a backlog increase in 2023. Most see a 5% to 9% increase (Fig. 6), but nearly 20% say it could rise 10% to 14%.

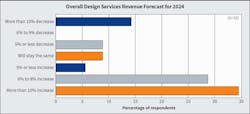

On revenue, the outlook is mostly sunny. A plurality of firms (one in three) expect a revenue boost of 10% or more this year (Fig. 7).

Firms elaborating on their survey responses were largely satisfied with how 2023 turned out. More importantly, they’re confident about their prospects coming off a year that delivered either solid growth or evidence that long-term demand for their services is solidly intact.

Underlying strength

HED (No. 32), Royal Oak, Mich. saw its revenue decline more than 30%, but Michael Cooper, managing principal/president, doesn’t see that as cause for alarm. Coming off a strong 2022 when revenue rose some 90% as pandemic-stalled business restarted, the company had to readjust to a normalizing business environment and work through an internal restructuring prioritizing cultivation of market sector design expertise.

“Last year presented some economic uncertainty and more severe labor shortages, but we remain optimistic about growing our electrical engineering practice,” Cooper says. “(The reorganization) positions us for future growth, higher operational efficiency, and a stronger value proposition.”

Citing growing prospects for a taming of inflation and falling interest rates, supply chains untangling, and recession talk fading as the economy seems to strengthen, Cooper sees a solid 2024 unfolding for the company. Specific market sectors do bear watching as they’re sensitive to macroeconomic forces and investment decisions, he says, but “we see significant opportunities and are extremely optimistic.”

Overall economic conditions and continued recession talk are the top current threats to company growth for Kunal Shah, president/CEO of PBS Engineers, Inc. (No. 34), Glendora, Calif. Total company revenue grew 40% in 2023 while electrical grew 10%, and 2024 is shaping up as a flattish year for revenues due to stubborn inflation, supply chain, and interest rate pressures on the client base.

The bigger story for PBS on the electrical side is that it made substantial progress in cementing ties with customers by expanding the scope of its design services. By cultivating and marketing growing expertise in the progressive design-build model, Shah says, the company found a way to work more closely and collaboratively with clients in markets such as utilities, aviation, and transportation — where complex project delivery processes can benefit from enhanced cooperation, sharing and early involvement from all parties. The key has been identifying project “pain points,” such as costly change-orders, which can be mitigated through better communication and deeper involvement by the design team.

“We’ve worked in this capacity before, but not at the volume we are now,” Shah says. “We’re focused more on the entire life cycle of a project — from pre-construction, construction design, and through to closeout. Partnerships that bring in expertise from both the design and construction perspective bring value, and last year we really started to see the fruits of those relationships."

Market trends steady

That anticipated revolution in the power generation and T&D world kept the sector near the top of the list of hot 2023 market sectors for the Top 40 (Table 1). It ranked third, with 30% naming it one of their three most active market sectors, behind health care (46%) and education/institution (32%). Rounding out the top five were government (24%) and data centers, government and water/wastewater (22% each). The top hot market sectors in the 2023 survey were health care, power/T&D, education, renewables, manufacturing, and data centers.

Close, long-standing ties with customers in the highly active utility sector (its primary market) worked to the benefit of Mesa Associates, Inc. (No. 6), Madison, Ala. in 2023. The firm saw electrical design revenue advance a modest 5%, much of it coming from 10 primary clients who generate about 80% of revenues, says General Manager Reggie Headrick. Demand was on the lighter side as interest rates kept a lid on some projects, but all signs point to sustained growth as utilities look to invest more in infrastructure upgrades that will demand specialized competence and expertise on the design services side.

“The renewables space got more of Mesa’s attention beginning in the middle of last year,” Headrick says. “Utilities are focused on decarbonization, and that will probably keep their spending at a historically high level. We’ll reap more of the benefits this year.”

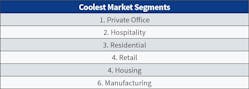

Sectors ranked particularly sluggish this year were private office, hospitality, retail, residential, housing, and manufacturing (Table 2). Neither private office, residential, or housing were in last year’s top five. Last year’s ranking was retail, hospitality, manufacturing, food & beverage, aviation, and sports/recreation.

Both rankings amply reflect where money is going due to demographic shifts and societal responses to emerging challenges and changing norms. And more than a few sectors are ones that have a pronounced electrical component, such as data centers, power, renewables, residential, and office.

Core States Group (No. 40), Duluth, Ga. saw two sectors emerge with more force. Health care raised its profile because project demand is growing as the population ages, and more residential projects — notably multi-family/mixed use — that address housing shortages, came the company’s way.

“The company’s acquisition of an architectural practice brought in more housing, and our work in health care, which has pretty consistent demand, would probably be good to bolt on in a similar way because it doesn’t swing with the economy as much,” says John Ferguson, senior director of engineering.

Looking ahead, Chris Sacco, director of electrical engineering, sees opportunity in food & beverage, which is resurfacing as a market with new site concepts, and within the office space, where ground-up and renovation projects are incorporating smart management concepts that demand heavy electrical know-how.

The office market has fallen off the radar of Henderson Engineers (No. 11), Lenexa, Kan. It, along with hospitality and residential, were slow in 2023. Since those turned down, the company has slowly migrated to sectors with more promise, steadily building up staff expertise to handle expected demand, says Jason Wollum, chief growth officer. Data centers, aviation, and sports/recreation fit that bill and topped the list of active markets. They’ll likely get more competition for a spot on future hot lists from a host of sectors, he says, from ones due for a comeback like retail, grocery, and office to those that align with trends in science and technology, such as laboratories, mission critical, and connected infrastructure.

“In building our staff for growing areas of the market, important areas of expertise will be in controls, integrated automation, and medium-voltage system design,” Wollum says, adding that building a company presence in areas that are “hotbeds” for innovation is on the radar.

New York-based Jaros, Baum & Bolles (No. 30) saw strong demand in aviation, health care, and residential, while education/institution, hospitality, and retail gained little traction. Once-reliable office projects remain mired in a slump, but those less reliant on private funding have filled some of the gap, says John Koch, a firm partner. An exception is high-end residential, where the company has seized opportunity from a boom in lavish, well-funded projects in Florida especially. Besides that ultra specialty, other rising markets have helped the firm diversify.

“Over the past 10 to 12 years, we’ve diversified, and growth in sectors like institutional, infrastructure, energy storage, and grid utility have picked up,” Koch says. “The electrification push keeps going, too, and that’s presenting some opportunities in projects we haven’t seen in the past.”

Rating an infrastructure boost

Design firms are likely to see a fair number of novel market opportunities emerge in coming years. A key contributor might be growth in infrastructure spending, some of which might call for a substantial electrical element. But few Top 40 firms see any big dollars flowing their way soon, specifically from federal infrastructure investment.

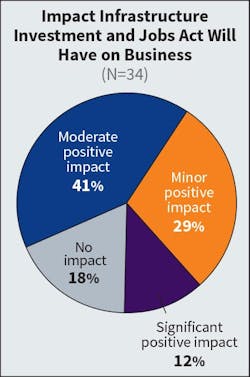

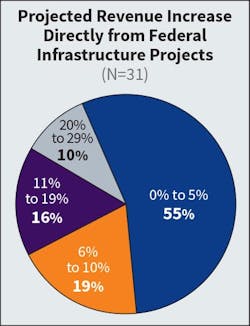

All but about 10% of firms saw, at best, only moderate positive impact from the 2021 Infrastructure Investment and Jobs Act (Fig. 8) now starting to roll out. Fewer this year than last, in fact, expect to realize a significant current year positive impact. And fewer see anything close to a double-digit boost to their top line in 2024. Half see just a 0% to 5% impact, up from 35% of last year’s Top 40 (Fig. 9). More than half last year predicted a 6% to 19% boost, but that fell to 19% this year. As for sectors likely to get a boost from the Act this year, electric vehicle (EV) charging infrastructure, renewables (solar and wind), and electric grid updates led the way again (Table 3).

In its primary electrical design role of providing a broad array of services to small utilities, chiefly in the Midwest, Toth and Associates, Inc. (No. 27), Springfield, Mo., is poised to benefit from more electrical infrastructure spending, public or private. President Adam Toth, P.E. says he’s waiting to see if infrastructure upgrade grants sought on behalf of some clients will materialize.

“Smaller utilities that haven’t done much in the last 60 years now have to update to newer equipment,” he says. “A lot of it needs to be replaced."

Ultimately, Toth sees the impact of infrastructure spending on the firm to be more indirect. Designing systems for utilities to furnish power to lithium miners that will be needed for EV expansion, for instance, might be one route. A below-the-radar benefit might be conducting studies to gauge the feasibility of utilizing rural utility power lines for fiber cable needed to develop more rural broadband — one target of the federal infrastructure plan.

Though he doesn’t see much direct infrastructure spending impact now, HED’s Cooper views the federal government’s growing role in the economy, more broadly, as a potential new vein of growth. Its decision to dive deeper into select sectors to spur growth elevates government as a market target. Its present strong private market orientation likely forecloses a windfall from most current infrastructure spending, Cooper says, but the prospect of expanded long-term federal investments in housing, health care, research, and mission critical offers “long-term opportunity with significant upside."

Should infrastructure spending get on a sustained roll, electrical designers are almost certain to benefit. That, along with the trend to widespread electrification of the economy, expansion of electrical grid modernization, and sustained economic growth lifting all boats will give them a commanding role in how things get built.

Staffing worries redux

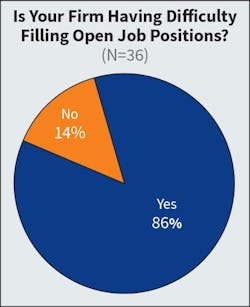

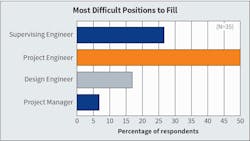

To do that, they’ll need top-flight design talent in sufficient numbers to take on the work they need to thrive. But finding and keeping that asset has been and remains a challenge, as survey results through the years attest. Though down from 94% last year, 86% of firms said they’re having a hard time filling open positions (Fig. 10). That figure has consistently been in the 80% to 90% range, dipping to around 70% only during the pandemic. What’s the most challenging position to fill these days? Project engineer, the essential role that continues to top the list by a good margin (Fig. 11).

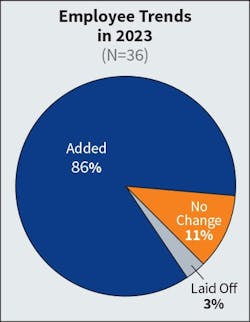

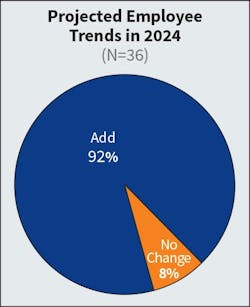

Tough or not, firms continue to staff up. Most (86%) said they added employees (Fig. 12), though that was down from 92% last year. For 2024, all but a few say their head count will grow (Fig. 13).

Staffing is, by far, the biggest worry for companies looking to excel and grow in a demanding market bursting with potential. From a list of plausible barriers to growth, difficulty finding and keeping “quality” staff was again the single factor most chose to the exclusion of others (Table 4). Only economic conditions and the prospect of recession came close.

Toth and Associates’ growth and near-exclusive focus on the small utility market necessitates but complicates the hunt for design talent. Preferred experienced talent is in shorter supply, but the firm’s location in a more rural setting makes attracting a greener pool harder. Additionally, the company is firm on in-office presence, ruling out recruits who may desire more remote arrangements.

“Finding experienced people here is hard, and they don’t teach in college a lot of what we do here, but if you’re growing like we are you have to find talent,” Toth says. “We can train young engineers, but they can be difficult to hire.”

There’s some concern at Mesa Associates about the future availability and quality of design talent. The company continues to hire, Headrick says, but worries that bidding wars for experience carries the risk of increasing the cost of design services.

The talent crunch, he says, “is getting more pronounced, with not near as many going into the field.” The company outsources some of its recruiting in a bid to find experienced engineers who can fit into the minority-owned firm’s culture, which can be a competitive advantage. Entry-level talent is sought, but there’s always the challenge of training given the “steep learning curve” that exists, he says.

Like many others, Core States Group confronts that problem with heavy reliance on an intern pipeline. Promising students are regularly brought in and immersed in the types of projects and subject matter they’d encounter. The approach has largely worked, says John Ferguson, senior director of engineering, because a fair number bridges some of the experience gap and land on the company’s payroll.

“Coming out of college, the theory is there but not so much the practical knowledge,” he says, adding that an approach that accelerates its uptake among raw talent can be more appealing than seeking more costly senior talent in the current labor market.

Training pressures mount

To take that route — and also address the hardening demand for staying current on critical areas of knowledge — design firms must be ever more focused on training. Imparting knowledge to younger recruits and keeping all staffers up to date on fast-moving change in electrical design demands dedication to education.

Rankings of areas where firms say they need the most training support may partly reflect emerging market priorities for firms. Growth in transmission and distribution projects, for instance, necessitates power systems analysis training, again listed by more firms than any other as a training area where the most support is needed (Table 5).

Also commonly mentioned were electrical design software, important as technology applications advance, and building management/automation systems, reflective of more smart building projects.

The latter is a top priority at HED because the firm is growing that facet of its electrical design practice. Many new hires often come with fairly robust technology skills that bring staff up a notch in that area, Cooper says, but building management systems design demand a “specialized and scare set of skills needed to respond,” that only robust training can address. Training is a focus, generally, he adds, because a shortage of experienced talent has led HED to hire more recent graduates and invest more in their professional development.

Being an employee-owned company that offers more than a paycheck gives Henderson Engineers an advantage in hiring more scarce talent, Wollum says. In hiring mode and concerned about the electrical talent pipeline, the company has forged ties to feeder universities with the aim of “making sure the curriculum they have is preparing students to work in the industry.” It’s also working closely with STEM-related programs to help mint younger talent that might find its way to the field and, possibly, Henderson, motivated to make their mark in a growing and consequential profession.

“Across multiple market sectors, many new projects we work on today are just cool,” Wollum observes. “People who get into the field can live their design dream working on projects they have a passion for.”

AI joins tech mix

Against a backdrop of staffing concerns, the practice of electrical design continues to change, utilizing more technology that could ease those worries by making designers more efficient and productive. Among them are augmented reality (AR) and virtual reality (VR) aids, and new on the scene is artificial intelligence (AI).

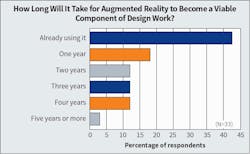

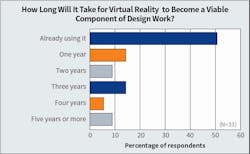

AR and VR are making slow, steady inroads into electrical design. More than 40% of Top 40 firms are using AR (Fig. 14) and around half are using VR (Fig. 15) in that capacity. Among possible broad applications for each, collaboration with clients and other project delivery partners are cited by most (Fig. 16 and Fig. 17).

Those now using AR in electrical work say its applications include supplementing 3-D modeling, helping design equipment layout, aiding conduit routing, and assisting virtual construction/product troubleshooting. VR applications span equipment room walk-throughs, design option evaluations, deeper understanding of complex systems and site investigations to document as-built conditions.

Echoing other firms, JB&B’s Koch characterizes AR/VR as still being in their “infancy” as design tools. They show promise, he says, and are being leveraged where possible to make the firm’s essential product — construction documents — more useful, especially in larger projects. But the technology “has to ramp up over time, and the ability to scale it is key.” Likewise, PBS’s Shah says AR/VR and other technologies for electrical design will evolve, with “every iteration focused on how to better harness the tools,” and be like “going from AutoCAD to Revit.”

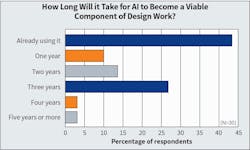

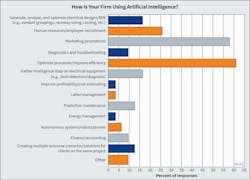

With AI, design firms say they have a potentially powerful and versatile tool that can aid all elements of their business. While a majority say using it in an electrical design capacity is a ways off, more than 40% say they’re doing so now (Fig. 18), primarily to aid process optimization/efficiency improvement; marketing and promotion tasks; and human resources/recruitment functions (Fig. 19).

Citing statistics showing more than 40% of AEC firms are using artificial intelligence (AI) in some fashion, Mesa’s Headrick says the firm has gotten on board, forming a team to explore its possible applications. So far, there’s been progress on using it for project management, enabling “lessons learned to be better shared and used by project managers to for process and procedure control.” AI may also be leveraged to help utility clients make better sense of their data and use it “to predict the end of asset useful life and important predictors of failure.”

At Core States, AI could become an important element of the technology tool bag the company uses to put a microscope on projects and processes.

“We have a formal design, efficiency, and analytics team whose job it is to analyze design and delivery models, and some in that group are interested in AI,” says Sacco. “The team is interested in determining ahead of time where we can improve and how to deliver our product quicker and more completely. AI could help improve the efficiency of that effort.”

In some respects, AI’s sudden emergence in 2023 helps clarify the road ahead for the electrical design field. Relying as it does on inputs of correct, proven and reliable data, designs that can be readily improved and refined in that regard will become the gold standard. Billed as possibly transformative for the broad economy, AI could be revolutionary for an industry poised for a critical role in a new, emerging construction economy and a more electrified world.

“The AEC industry is due for major change in delivery methods, from conception through construction, commissioning, and maintenance,” says Wollum. “There is an opportunity for us to leverage change, embrace technology in the form of AI and other generative and automated design concepts. It’s a very exciting time of change in the industry.”